Of the $3500.00 you may have paid in Federal taxes:

$1048.89 goes to the military

$651.10 goes to pay the interest on the

$709.58 goes to health care

$230.36 goes to income security

$128.45 goes to education

$120.32 goes to benefits for veterans

$94.10 goes to nutrition spending

$75.03 goes to housing

$60.36 goes to environmental protection

$32.80 goes to job training

$368.03 goes to all other expenses

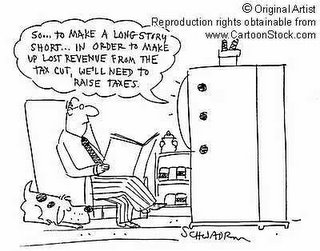

How can we possibly reduce the federal deficit and find enough money for high-quality public services without raising everyone's taxes? We cannot. With our current tax structure we cannot have both guns and butter.

The Internal Revenue Service recently released a report estimating that taxes owed but not collected in 2001 (the last year studied) ranged from $312 billion to $353 billion. That didn't even count much of the tax evasion by US firms offshore.

Last fall, Citizens for Tax Justice examined federal taxes paid by 275 of America's largest corporations. On average, they paid a rate of 17.3 percent -- lower than the rate paid by nearly everyone who is reading this column.

The statutory corporate rate is 35 percent. The fact that the taxes actually paid were less than half that amount reflects a blend of special-interest laws, shelters, and outright tax-cheating. As McIntyre observes, in the 1950s, US corporations paid 4.8 percent of the gross domestic product in taxes. By 2004 that had fallen to 1.6 percent.

We the Rable have two choices, we can lobby collectively to demand that corporations pay their fair share of the tax burden or we can pay more of our hard earned dollars so that wealthy businesses can pay less. There is of course a third option. This would be to allow our Republican lead government to "starve the beast". If we continue on our present course of tax cuts and increased spending, our government will eventually bankrupt and we will have no other option but to abandon the social programs that have made us an egalitarian society. In short, the citizens that need the most help would receive the least. This trend is gaining momentum in Washington, as reflected in the last budget cuts, and is largely going unnoticed by the majority of Americans. What's more important to you? Tax cuts for wealthy corporate citizens or pre-kindergarten care for less fortunate children?

Famous Quotes:

Only the little people pay taxes. - Leona Helmsley

The avoidance of taxes is the only intellectual pursuit that carries any reward. - John Maynard Keynes

10 Comments:

So, I'm taking a break from working on my taxes, cruising around my favorite blogs - and here's where I land.

My first reaction is "guns for us, butter for them", but we don't even get the guns unless we're of age and willing to fight the unnecessary wars that enrich THEM.

After reading the breakdown of where my $$ goes, I think I need a drink before tackling the 1040 again.

Good lord, now I am reminded why I don't get too involved in issues like this. Either I am lost or my ideas are too radical to be practical.

3 questions, on 2 topics:

a) what is nutrition spending? (honestly, I can figure the rest out but what programs fall under this.)

b) "pre-kindergarten", really how far do you go? I did fine with kindergarten then 1st grade. By pre- "kinder" and "first" aren't you really just talking about daycare? Will there be "pre-pre-kindergarten"?

So where's all this money I keep hearing people bitch about going to welfare?

van,

nice place you've got here. My brother lives in St. Pete, and it's good to see someone more progressive than him spreading the word.

Also,

the $39 billion dollar "Deficit Reduction" package that was passed and signed is no longer operable. It turns out there was a discrepancy between the House version and the Senate version, so the bill the President signed was not approved by both houses of Congress.

The whole thing has to get voted on again either in the House or Senate, and no one's even trying to do it.

They're scared of their voters...finally.

andante said...

"After reading the breakdown of where my $$ goes, I think I need a drink before tackling the 1040 again."

I think that what distrubs me the most is the amount of interest that we pay on our debt. It is nearly the amount that we pay in military spending - this hurts!

I learned recently that Japan is earning more from the interest on our debt than all of it's exports combined!! (APM's Market Place)

This is amazing to me since before Reganonics we were the primary lender to the world. Actually our debt stated to grow in the mid 70's, but under the Reagan Administration (borrow and spend) our deficit went way up and never stoped.

12/31/1979 845,116,000,000.00

09/30/1988 2,602,337,712,041.16

09/30/1996 5,224,810,939,135.73

09/30/2003 - $6,783,231,062,743.62

Now it's closer to 8 trillion.

This is not a result of tax and spend, this is the result of spend and borrow. So what happens when Saudi Arabia, China, Japan and North Korea no longer buy T-Bills?

A very long recession, and very high taxes.

Brace for impact boys, this one is gonna hurt!

MD-

Research shows that attending a high-quality preschool can have a substantial impact on a child’s success in school: improving the likelihood of learning to read by the third grade, reducing the chance of being held back for a grade or placed in special education, and increasing the possibility of graduating from high school.

LEARN TO READ BY 3RD GRADE?

Are you kidding me? I was reading and writing by the 1st grade, I was learning how to write checks properly in 2nd.

I am sorry but there are bigger issues in a situation than pre-school if you are not reading by 3rd grade. I am not doubting you (well to a degree), but not because I think you are lying. Is any of this research on the net? I am not asking you to prove yourself but I am really curious.

I'd love to read about this and how they came to these conclusions. I don't need tons of the research, but just something.

http://nieer.org/faq/

http://www.preknow.org/media/faq.cfm

and

http://www.rand.org/pubs/research_briefs/RB9101/index1.html

The last link is the most detailed.

"...the benefits of high-quality early childhood experiences are not entirely or even primarily academic..."

So this means the Government can say what is best for a persons child? It states not academic, so I can see children being forced into "pre-education" even if parents don't want it. Others will use it as nothing more than daycare.

How about the Government looking into what parents can do themselves instead of coming up with another reason to remove children from the home environment?

Why can't we make the parents responsible, not a state mandate "pre-k."

Well, there is a variety of reasons. I suppose that some parents are ignorant, some work too often, and some are just lazy.

These programs are optional. What confuses me about objection to these programs is that the protests usually come from conservatives, but conservatives are the ones who usually complain that there are too many on State Welfare, in jail, drop-outs,etc.

These programs have a track history of preventing this sort of burden to society. A small cost up front and a hugh benefit to society in the long run.

Incidentally, The Rand Institute is not exaclty a partician liberal group. They are a think tank founded by an airline manufacturer.

"An ounce of prevention is worth a pound of cure"

Post a Comment

<< Home